http://quote.bloomberg.com/apps/news?pid=10000006&sid=aGM4EaFiVQDo&refer=home

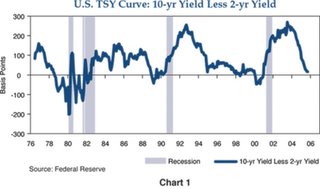

no worries, the chairman of the federal reserve said we don't have to worry about the inverted yield curve. it doesn't predict recessions.

uhhhh.... what did he say?

also from the article: ``If spending depends on long-term interest rates,'' Bernanke said, and special factors lower those rates, then demand will be stimulated and `a higher short-term rate is required.''

that should be interpreted as meaning that he will not only continue to raise short term interest rates which drive prime, but that the lower the long-term yields stay the more stimulative they are thus requiring more tighting of the short rates..

he also said some other stupid shit and i am very concerned this guy doesn't know his head from his ass.... very concerned.

No comments:

Post a Comment